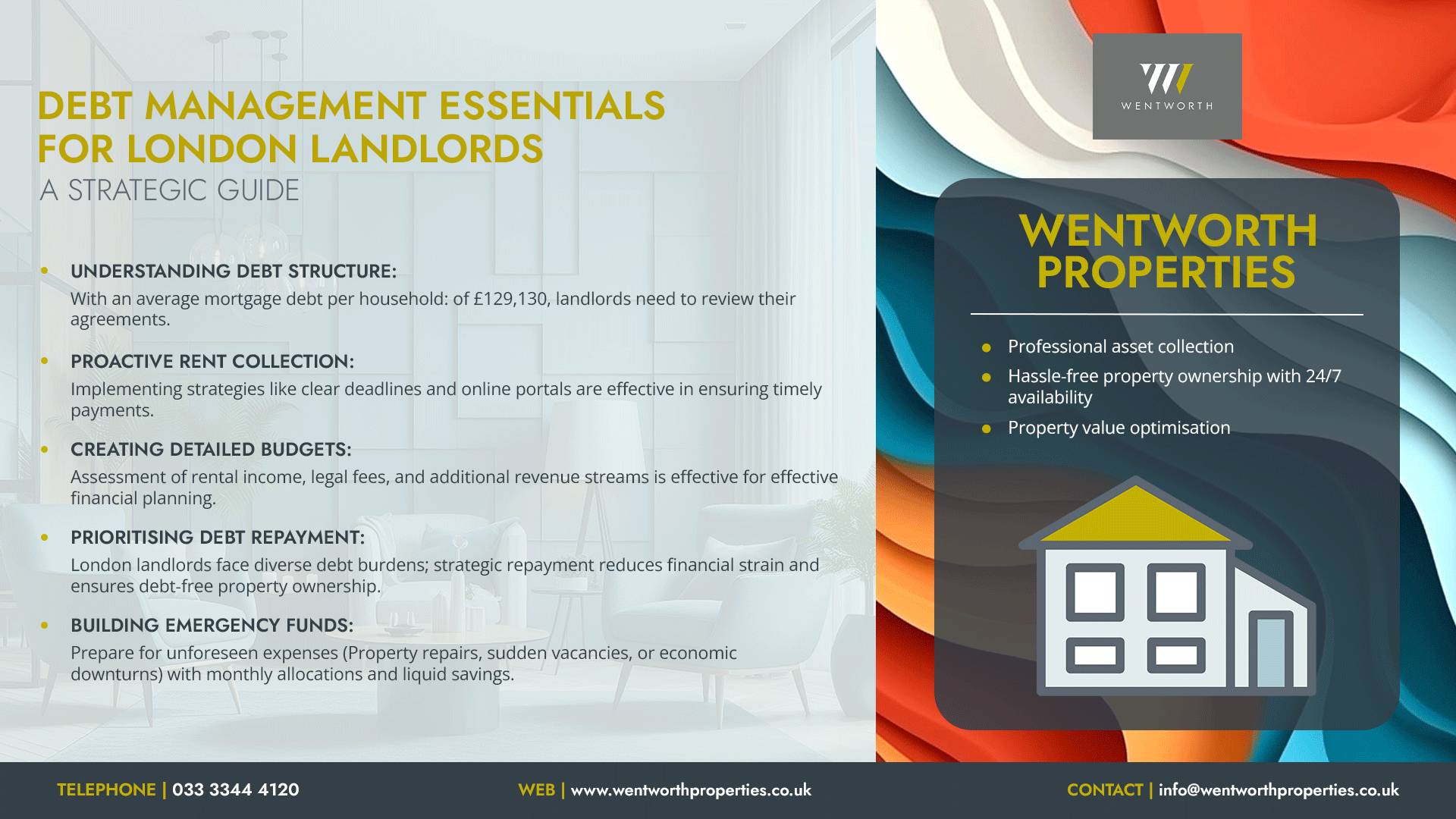

Financial Wellness in Real Estate Rental Property Management in London: Debt Management Essentials for Landlords

In the bustling real estate market of London, managing rental properties can be a lucrative endeavour. However, to ensure long-term success and financial wellness, landlords need to prioritise effective debt management strategies.

From mortgage payments to property maintenance costs, debt management plays a crucial role in maintaining profitability and minimising financial risks. In this comprehensive guide, we’ll explore the top five debt management essentials for landlords in real estate rental property management in London, empowering them to achieve financial stability and success.

Understanding Debt Structure

Effective debt management begins with a clear understanding of the debt structure associated with rental properties. Let’s first consider the debt structure in the UK.

- In 2023, the average mortgage debt per household in the UK stood at £129,130.

- As of March that year, there were approximately 13.15 million outstanding mortgages in the UK, amounting to nearly £1.7 trillion.

- By November 2023, the average house price in the UK had reached £285,000.

This is because many homeowners own their homes completely. In this regard, landlords need to meticulously review their mortgage agreements, including interest rates, repayment terms, and any associated fees. By understanding the terms of their debt, landlords can make informed decisions about managing cash flow and optimising property investments.

Implementing Proactive Rent Collection Strategies

Late or unpaid rent can significantly impact landlords’ cash flow and ability to manage debt effectively. To mitigate this risk, landlords should implement proactive rent collection strategies. This may include setting clear rent payment deadlines, offering incentives for early payment, and enforcing late payment penalties. Additionally, landlords can leverage technology to streamline rent collection processes, such as online payment portals and automated reminders.

Creating a Detailed Budget

A well-defined budget is essential for effective debt management in real estate rental property management. In this regard, landlords need to carefully assess the following aspects-

| Income Assessment: | Rental Income: Begin by evaluating the rental income generated from your properties. Consider both short-term and long-term rentals, as London attracts tourists, business travellers, and long-term residents alike. Additional Revenue Streams: Explore supplementary income sources, such as parking fees, laundry facilities, or pet fees. |

| Legal and Compliance Costs: | Legal Fees: Budget for legal consultations, lease agreements, and any eviction proceedings. Compliance: Comply with local regulations, safety standards, and licencing requirements. |

| Technology and Marketing: | Online Platforms: Allocate funds for property listings, professional photography, and virtual tours. London’s tech-savvy renters rely on digital channels. Advertising: Promote your properties through targeted marketing campaigns. |

Furthermore, they need to consider income and expenses, including mortgage payments, property taxes, insurance premiums, and maintenance costs. In this way, by creating a detailed budget, landlords can identify areas where they can reduce expenses, allocate funds for debt repayment, and build financial reserves for unexpected expenses.

Prioritizing Debt Repayment

When overseeing multiple properties, landlords encounter a spectrum of debt obligations, spanning mortgage loans, lines of credit, and personal loans. In December 2023, the average price of a house in London was £508,000, according to data from the Land Registry. Despite these soaring property values, landlords in the capital faced a diverse array of debt burdens, including mortgages and other financial commitments. To navigate these financial responsibilities effectively, landlords in London, one of the world’s most dynamic real estate markets, need to adopt a strategic approach to debt repayment.

Moreover, in real estate rental property management, implementing a systematic debt repayment strategy is crucial for London landlords. This strategy may involve allocating a set portion of rental income towards debt repayment each month or quarter, thereby steadily reducing outstanding balances.

By leveraging statistical data and understanding the unique dynamics of the London property market, landlords can make informed decisions to effectively manage and prioritise debt repayment. This approach not only minimises financial strain but also accelerates the journey towards debt-free property ownership, enhancing overall financial wellness and stability in the competitive London real estate landscape.

[Source: https://uk.finance.yahoo.com/news/london-house-prices-fell-2023-105551082.html]

Building Emergency Funds

In the unpredictable world of real estate rental property management, having sufficient emergency funds is essential for weathering financial challenges. Here’s why building emergency funds is crucial:

- Unpredictable Expenses

Property repairs, sudden vacancies, or economic downturns can catch landlords off guard. Having reserves ensures you can handle these unexpected costs without jeopardising your investment.

- Market Volatility

London’s property market is dynamic. Emergency funds act as a buffer during market fluctuations, allowing you to maintain stability.

For these above-mentioned reasons, landlords need to prioritise building reserves to cover unexpected expenses, such as property repairs, vacancy periods, and economic downturns. In this regard, the following strategies can be helpful-

- Monthly Allocation

Set aside a portion of rental income each month specifically for emergencies.

- Liquid Savings

Keep funds accessible in a savings account or money market fund.

- Risk Assessment

Evaluate potential risks (e.g., property age, location) and allocate funds accordingly.

- Regular Review

Revisit your emergency fund periodically to adjust based on market conditions.

In these ways, landlords can mitigate the financial impact of unforeseen events and ensure the long-term sustainability of their property investments.

Final thoughts

Achieving financial wellness in rental property management in London requires proactive debt management strategies and prudent financial planning. By understanding debt structures, creating detailed budgets, implementing proactive rent collection strategies, prioritising debt repayment, and building emergency funds, landlords can navigate the complexities of debt management effectively. With these essential practices in place, landlords can optimise cash flow, minimise financial risks, and achieve long-term success in London’s competitive rental property market.

For tailored guidance and expert assistance in optimising debt management strategies for your rental property portfolio, consider partnering with Wentworth Properties. Our experienced team specialises in helping landlords in London effectively manage their debt obligations, maximise cash flow, and minimise financial risks. Contact us today for personalised advice and support on achieving long-term success in London’s competitive rental property market. Take the first step towards financial empowerment with Wentworth Properties by your side.

Unlock Your Property Portfolio's Potential: Expert Debt Management Guidance from Wentworth Properties

- Ready to optimise your debt management strategy? Contact Wentworth Properties today for personalised guidance tailored to your rental property portfolio.

- Maximise your cash flow and minimise financial risks with Wentworth Properties’ expert debt management assistance. Get in touch now for a consultation!

- Achieve financial stability in London’s competitive rental market with Wentworth Properties by your side. Schedule a meeting today to discuss your debt management needs.

- Don’t let debt hold back your property investments. Partner with Wentworth Properties for professional guidance on effective debt management strategies. Reach out now to get started!

FAQ:

Landlords in London may encounter various debt obligations, including mortgage loans, lines of credit, personal loans, and expenses related to property maintenance, repairs, and legal fees.

Landlords can implement proactive debt management strategies, such as understanding debt structures, creating detailed budgets, implementing rent collection strategies, prioritising debt repayment, and building emergency funds to achieve financial wellness in rental property management.

Building emergency funds is crucial for landlords in London as it helps them cover unexpected expenses, such as property repairs, sudden vacancies, or economic downturns. Emergency funds act as a buffer during market fluctuations, ensuring stability and long-term sustainability in the competitive rental property market.

Landlords can prioritise debt repayment by allocating a set portion of rental income towards debt repayment each month or quarter. Additionally, leveraging statistical data and understanding the dynamics of the London property market can help landlords make informed decisions to accelerate the journey towards debt-free property ownership.

Proactive rent collection is essential for landlords in London to mitigate the risk of late or unpaid rent, which can significantly impact cash flow and debt management efforts. Implementing rent collection strategies, such as setting clear payment deadlines, offering incentives for early payment, and leveraging technology for streamlined processes, can help landlords maintain financial stability and minimise financial risks.