7 Tips for Viewing Properties and Making Choices in London for First-time Buyers

Are you concerned about how to buy a house for the first time in London?

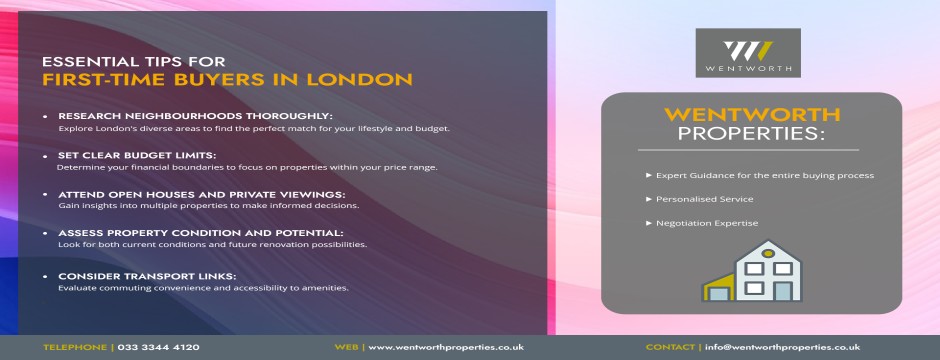

Well, buying your first home in London can be both thrilling and daunting. As a first-time buyer, navigating the diverse and competitive London property market requires careful planning and informed decision-making. Here, viewing properties effectively is crucial to finding the right home that meets your needs and fits your budget. So, we have come up with seven essential tips to help you make smart choices when viewing properties in London.

1. Research Neighbourhoods Thoroughly

London is a vast city with a wide range of neighbourhoods, each offering its unique character and amenities. Before scheduling viewings, you can research different areas to determine which ones align with your lifestyle preferences, budget, and commuting needs. Also, consider factors such as proximity to schools, transport links, local amenities, and safety ratings. Popular residential areas for first-time buyers in London include-

Greenwich | Located in southeast London, Greenwich offers a blend of historic charm with modern conveniences. Home to the Royal Observatory and Greenwich Park, this area boasts excellent transport links, riverside views, and a vibrant market scene. So, if you are looking for a lively yet culturally rich neighbourhood, this location is ideal for you. |

Clapham | Situated in southwest London, Clapham is known for its spacious Victorian houses, leafy streets, and bustling high streets. It’s popular among young professionals and families for its vibrant nightlife, green spaces like Clapham Common, and excellent transport links to central London and beyond. |

Hackney | Located in East London, Hackney has undergone significant regeneration, making it a hotspot for creatives and young professionals. With its diverse community, trendy cafes, markets like Broadway Market, and proximity to tech hubs like Silicon Roundabout, Hackney offers a dynamic urban lifestyle with a creative edge. |

Canary Wharf | Situated in the Docklands area of East London, Canary Wharf is synonymous with sleek skyscrapers, corporate offices, and waterfront living. So, it’s perfect for professionals working in the financial district, offering modern apartments, shopping at the Canary Wharf Mall, waterfront dining options, and efficient transport links via the Jubilee Line and DLR. |

2. Set Clear Budget Limits

In case you are concerned about ‘how to buy a house for the first time in London’, it is necessary to remember that establishing a clear budget is essential before viewing properties in London. Take into account your deposit amount, mortgage eligibility, and additional costs such as stamp duty, legal fees, and potential renovations.

Between March 2023 and 2024, house prices in London experienced a decline of 3.4%. Despite a one percent increase in property prices across England over the past year, London has consistently seen a decrease in housing prices. The average price of a house in London now stands at £499,663. According to the latest House Price Index from the HM Land Registry, the first time it has fallen below the half-million-pound mark since July 2021.

In this regard, knowing your financial limits will help you focus on properties within your price range and avoid disappointment or financial strain later on. London’s property prices vary significantly across neighbourhoods. So, understanding your budget constraints early will streamline your search process.

3. Attend Open Houses and Private Viewings

In London’s competitive property market, attending both open houses and private viewings is advantageous.

- Open houses- They help you explore multiple properties in a single day, gaining insight into different styles and layouts.

- Private viewings-They offer a more personalised experience. Here, you can ask detailed questions and assess the property’s condition more thoroughly.

So, be prepared to ask about the property’s history, any ongoing maintenance issues, and the seller’s motivations for selling. For this, you can consult London property management experts.

4. Assess Property Condition and Potential

When you are conscious about ‘how to buy a house for the first time in London?’, pay close attention to both the interior and exterior conditions. So, look for signs of dampness, structural issues, or outdated fittings that may require renovation. Evaluate the property’s layout and potential for future improvements, such as converting loft spaces or extending kitchens. In London, properties with renovation potential can offer value opportunities, but ensure any necessary work aligns with your budget and timeline.

5. Consider Transport Links and Commuting Times

London’s transport network is extensive, but commuting times can vary significantly depending on location. Evaluate the property’s proximity to tube stations, bus routes, and major roads to gauge commuting convenience. Also, consider the implications of daily travel to work or school, and assess transport options for both current and potential future needs. Properties with excellent transport links often command higher prices but may offer long-term benefits in terms of accessibility and resale value.

6. Consult with Local Experts and Advisors

Navigating London’s property market as a first-time buyer can be complex. So, for this, you can seek guidance from local estate agents who specialise in the areas you’re interested in. They can provide valuable insights into market trends, negotiate on your behalf, and alert you to new listings before they hit the market.

Additionally, consulting with a mortgage advisor or financial planner for London property valuation will help you understand your borrowing capacity and financing options. It ensures you make informed decisions throughout the buying process.

7. Trust Your Instincts and Take Your Time

Purchasing your first home is a major commitment, both emotionally and financially. While it’s important to conduct thorough research and due diligence, trust your instincts when viewing properties. Consider how each property feels as a potential home, envisioning yourself living there and integrating into the local community. Take your time to weigh the pros and cons of each property and avoid feeling pressured to make a hasty decision. When learning how to buy a house for the first time in London, patience and perseverance will ultimately lead you to the right property that meets your criteria and feels like home.

Summary

Buying your first home in London is an exciting milestone that requires careful planning and thoughtful decision-making. By following these tips for viewing properties and making choices, you’ll be better equipped to navigate the complexities of London’s property market. Remember to research neighbourhoods thoroughly, set clear budget limits, attend both open houses and private viewings, assess property condition and potential, consider transport links, consult with local experts, and trust your instincts throughout the process. With diligence and patience, you’ll find the perfect home in London that suits your needs and aspirations as a first-time buyer.

Ready to find your ideal home in London? Whether you are concerned about how to buy a second house in London or a first house, let Wentworth Properties guide you through every step of the process. From selecting the right neighbourhood to negotiating the best deal, our expert team is here to support your journey to homeownership. So, contact Wentworth, one of the property management companies in London today to start your search and turn your dream of owning a home in London into a reality.

Start your search for your dream home in London with Wentworth Properties. Browse our curated listings now!

Schedule a viewing: Ready to see your future home? Contact us today to schedule a private viewing with one of our experienced agents.

Get Expert Advice: Unsure where to start? Speak with our knowledgeable team for expert guidance on buying your first home in London.

Request a Consultation: Let us help you navigate London’s competitive property market. Request a consultation today to discuss your buying goals and options.

FAQ

Answer: The first steps include assessing your financial situation, determining your budget, and obtaining mortgage pre-approval. Next, research various neighbourhoods in London to find ones that match your lifestyle and budget. Finally, engage with local estate agents who can provide valuable insights and help you navigate the property market.

Answer: Consider factors such as proximity to work, schools, transport links, local amenities, and safety. Each neighbourhood in London has its unique character and amenities. For instance, Greenwich offers historic charm, while Clapham is known for its vibrant nightlife and green spaces. Visiting different areas and consulting with local estate agents can help you make an informed decision.

Answer: When viewing properties, pay attention to both the interior and exterior conditions. Look for signs of dampness, structural issues, or outdated fittings that may require renovation. Assess the property’s layout and potential for future improvements. Additionally, consider the property’s proximity to transport links and its overall feel as a potential home.

Answer: Research the average property prices in the desired neighbourhood and compare similar properties currently on the market. Engaging with a local estate agent can also provide insights into market trends and help you negotiate a fair price. Additionally, consider getting a professional property valuation to ensure the asking price is reasonable.

Answer: Besides the purchase price, there are several additional costs to consider, such as stamp duty, legal fees, mortgage arrangement fees, and survey costs. You may also need to budget for potential renovations or repairs. It’s important to factor in these costs when determining your budget to avoid any financial strain later on.