Leverage Long-Term Investment Gains - Buying A House for The First Time in London

London’s real estate market offers incredible opportunities for long-term investment gains. Therefore, buying your first house here can be a smart move. You may wonder, “How to buy a house for the first time in London?”

With the right strategies, you can maximize your return on investment (ROI) and secure your financial future. Let’s dive into how you can make the most of London’s property market.

The London Real Estate Market

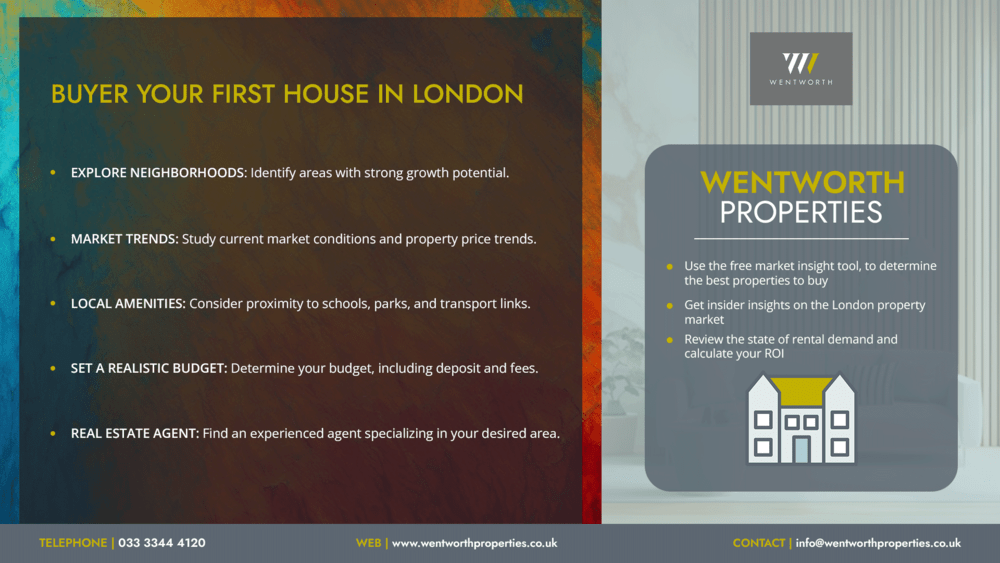

Before making any hefty purchase, it’s essential to understand London’s real estate landscape. London is a diverse city with various property types and neighbourhoods, each offering different investment potential.

Hence, research thoroughly to identify areas with strong growth prospects. In this case, professional estate agents of Wentworth Properties can help.

What Are The Key Factors Affecting Property Value?

Several factors influence property values in London. These include location, transport links, schools, amenities, and future development plans. Properties near good schools, parks, and transport hubs tend to appreciate faster. Keep these factors in mind when searching for your ideal property.

Choosing The Right Neighborhood

Choosing the right neighbourhood is crucial for maximizing ROI. Look for areas undergoing regeneration or with planned infrastructure projects. Moreover, these neighbourhoods often experience significant price increases over time.

London has several emerging hotspots worth considering. Areas like Finsbury Park are seeing substantial growth due to regeneration efforts. Investing in these areas early can yield high returns as they continue to develop. You can also contact our estate agents in Ilford for a better understanding of the house properties in the Ilford area.

Property Types & Their Investment Potential

Different property types offer varying investment potentials. Therefore, understanding the benefits and drawbacks of each can help you make an informed decision.

Apartments in London can be great for rental yields, while houses in suburban areas might offer better long-term appreciation. Hence, assess your investment goals and choose accordingly.

Camden and Tower Hamlets have much higher average rental returns, about 4.5% and 4.2%, respectively, contrasted to more central regions such as Westminster, which has yields of 2.8%.

Source: https://www.flatmates.uk/blog/londons-rental-yield-hotspots-where-to-invest-in-2024

Things to Be Considered

The Importance of Market Timing

If may want to know, how to buy a house for the first time in London. Therefore, timing your house purchase is critical. The London property market fluctuates, and buying during a downturn can maximize your ROI. Monitor market trends and economic indicators to identify the best time to buy.

You should also pay attention to factors like interest rates, employment rates, and government policies. These can significantly impact property prices and market conditions.

Then, securing the right financing is essential for a successful investment. Explore different mortgage options and consider consulting an expert.

Government Schemes And Incentives

First-time buyers in London can benefit from various government schemes. The Help to Buy and Shared Ownership programs can make buying more affordable. Hence, these schemes can also improve your investment’s overall profitability.

Renovations & Upgrades

Renovating your property can significantly increase its value. So, you may like to focus on upgrades that offer the highest return on investment, such as kitchen and bathroom renovations.

Not all upgrades need to be expensive. Simple improvements like repainting, landscaping, and updating fixtures can add considerable value to your property. Therefore, aim for cost-effective changes that enhance appeal.

Leveraging Rental Income

- If you’re not planning to live in your new home, renting it out can provide a steady income stream. This can help cover mortgage payments and generate additional profits. Therefore, to maximize rental yield, focus on properties in high-demand areas and ensure they are well-maintained.

- Offering furnished rentals can also attract higher rents and more tenants.

- Rental returns in London are good, averaging 3-5% in premium neighbourhoods, with some new build-to-rent buildings earning more than 7%. Hence, thinking of how to buy a second house in London is a fair one.

Source: https://www.hudsonsproperty.com/blog/investing-in-london-rental-properties-in-2024/

Long-Term Investment Strategies

Think long-term when investing in London real estate. Holding onto your property for several years can yield substantial appreciation and rental income. As you pay down your mortgage, you build equity in your property. This equity can be used to finance additional investments or improvements, further enhancing your ROI.

The Role of Professional Advice

Navigating the London property market can be complex. Therefore, working with professionals like real estate agents, financial advisors, and property managers can provide valuable insights and assistance.

Select professionals with experience in the London market. Their experience can help you make educated judgements and escape potential traps. A good team can be the difference between a good investment and a great one.

Understanding Legal Considerations

Property transactions in London involve various legal considerations. Ensuring you understand these can prevent issues and protect your investment.

Engage a qualified real estate agent to handle the conveyancing process. They will ensure all legal requirements are met and protect your interests. So, be prepared for legal fees, which are a necessary part of the buying process.

Sustainability And Future-Proofing

Consider sustainability when buying your property. Energy-efficient homes are increasingly in demand and can attract higher rents and sale prices.

Investing in green upgrades, like solar panels and energy-efficient windows, can increase your property’s value and appeal. These upgrades also contribute to long-term savings on utility bills.

End Note

Buying a house in London for the first time is a significant step towards securing long-term investment gains. Therefore, by understanding the market, choosing the right neighbourhood, leveraging financing options, and making strategic decisions, you can maximize your ROI.

Stay informed, be adaptable, and seek professional advice to navigate the complexities of the London real estate market. If you think about how to buy a house for the first time in London, reach the expert agents in London.

Start your journey by researching potential areas, understanding market trends, and seeking professional guidance. The London property market offers immense opportunities for those willing to invest time and effort. Hence, contact our agents to make your first property purchase a success and enjoy the long-term financial benefits it can bring.

- Start your property search in London today.

- Get expert advice – contact a London real estate agent today!

- Contact the best estate agents in London to maximize your ROI.

FAQ

Yes, first-time buyers in London benefit from a reduced Stamp Duty Land Tax (SDLT). It’s crucial to budget for SDLT and consult with an advisor to understand your obligations fully. You may also like to connect with one of our best estate agents in Ilford.

The condition of the property significantly impacts investment returns. Well-maintained properties attract higher rents and appreciate faster. Conversely, properties in poor condition may require substantial repairs, reducing short-term profits. Therefore, conduct thorough inspections and consider properties that need minor, cost-effective improvements to enhance value. It’ll help you if you are eager to know how to buy a second house in London.

The property market cycle consists of four phases: boom, downturn, stabilization, and recovery. Buying during a downturn or early recovery phase can maximize ROI, as property prices are lower, and the potential for appreciation is higher. Monitoring these cycles helps investors time their purchases strategically for optimal returns.

Leasehold properties come with additional risks and costs, such as ground rent, service charges, and lease extension fees. It’s essential to understand the terms of the lease, the remaining lease duration, and any potential costs associated with extending it. Hence, short leases can significantly reduce property value and increase costs, affecting ROI. So, if think about how to buy a house for the first time in London, contact the best letting agents for a secure ROI.

Property auctions can offer opportunities to buy properties below market value, which can lead to high ROI. However, auctions require thorough research and quick decision-making. Hence, ensure you understand the auction process, set a budget, and inspect properties beforehand. Auction purchases can be risky, but they can also provide significant investment gains if approached wisely.