Unlocking Steady Income: The Perks of London’s Guaranteed Rent Schemes for Landlords

If you’re a landlord in London, you know the drill: finding reliable tenants, dealing with maintenance issues, and, of course, the dreaded void periods where your property sits empty, and your income takes a hit.

It’s a lot to juggle, isn’t it?

Well, what if there was a way to sidestep these headaches and enjoy a steady income without all the fuss?

Wentworth has a solution for you. We bring you the Guaranteed Rent Scheme. Let’s unpack what this guaranteed rent London Ilford is all about and why it’s becoming the go-to choice for savvy landlords in London.

What's All the Fuss About Guaranteed Rent London Ilford?

Imagine this: a system where you receive a fixed monthly rent, come rain or shine, tenant or no tenant. That’s the essence of the Guaranteed Rent Scheme. Instead of the traditional model where your income depends on tenant payments, this scheme offers a safety net, ensuring your cash flow remains uninterrupted. It’s like having a financial cushion that absorbs the usual bumps and jolts of property management.

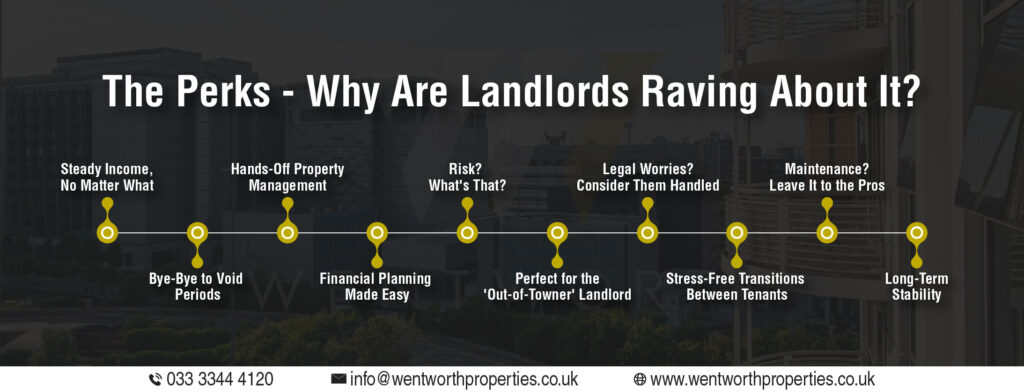

The Perks - Why Are Landlords Raving About It?

1.) Steady Income, No Matter What

With the Guaranteed Rent Scheme, the rental income on your rent property in Ilford is as predictable as your monthly Netflix subscription. Whether your property’s occupied or not, you get paid. This consistency makes budgeting a breeze and adds a layer of financial security that’s hard to beat.

2.) Bye-Bye to Void Periods

Vacant properties to rent in Ilford are every landlord’s nightmare. Not only do you lose rent, but there’s also the hassle of finding new tenants. With this scheme, void periods are a thing of the past. Your income continues uninterrupted, allowing you to focus on other ventures without the constant worry of vacancy.

3.) Hands-Off Property Management

Let’s face it: managing properties can be a full-time job. From screening tenants to handling late-night repair calls, it’s a lot. The Guaranteed Rent Scheme takes this load off your shoulders. The managing company handles everything—from maintenance to tenant issues—giving you more free time and less stress.

4.) Financial Planning Made Easy

Knowing exactly how much rent you’ll receive each month simplifies financial planning. Whether it’s covering mortgage payments, reinvesting in property, or planning a holiday, predictable income makes it all possible.

5.) Risk? What’s That?

The property market can be a rollercoaster, but with the Guaranteed Rent Scheme, you’re buckled in for a smooth ride. Fixed rental income shields you from market fluctuations and tenant payment issues, ensuring your investment remains stable.

6.) Perfect for the ‘Out-of-Towner’ Landlord

Not living near your rental property? No problem. The scheme provides a local presence to manage your property, making it ideal for absentee landlords who want to reap the benefits without the logistical headaches.

7.) Legal Worries? Consider Them Handled

Keeping up with London’s ever-evolving property laws can make your head spin. The Guaranteed Rent Scheme often includes legal support, ensuring your property meets all necessary standards and regulations, so you can sleep easy at night.

8.) Stress-Free Transitions Between Tenants

Tenant turnover can be a logistical nightmare. But with the scheme, the managing company handles tenant placement, ensuring quick transitions and minimal vacancy periods. They vet tenants thoroughly, reducing the risk of late payments and property damage.

9.) Maintenance? Leave It to the Pros

Regular upkeep is crucial to maintaining property value. The Guaranteed Rent Scheme often includes maintenance services, ensuring your property stays in top shape without you lifting a finger. From routine inspections to emergency repairs, it’s all covered.

10.) Long-Term Stability

Many schemes offer long-term agreements, providing landlords with extended financial security. This stability allows for better long-term planning and can be particularly beneficial for those looking to build a property portfolio.

Are There Any Catchy Bits? Things to Ponder

While the Guaranteed Rent Scheme sounds like a dream come true, it’s essential to consider the finer details:

- Management Fees: Quality service comes at a price. The managing company will charge fees for their services. It’s crucial to understand these costs and ensure they align with the level of service provided.

- Property Standards: Some schemes have specific requirements regarding the condition and furnishing of your property. Ensure your property meets these standards to qualify and avoid unexpected expenses.

- Contract Terms: These agreements can range from a few years to longer periods. It’s vital to understand the terms, including any exit clauses, to ensure flexibility if your circumstances change.

- Potentially Lower Rental Income: While guaranteed rent provides stability, the fixed monthly income may be lower than what you could achieve through traditional letting, especially in high-demand areas.

- Limited Control Over Tenant Selection: Depending on the arrangement, you may have limited say over who the tenants are, as the managing company typically handles tenant placement.

Is the Guaranteed Rent Scheme the Holy Grail for Every Landlord?

Not necessarily. While the scheme offers numerous benefits, it’s essential to assess your individual circumstances:

- Portfolio Size: If you have multiple properties, the scheme can simplify management. For single-property landlords, weigh the benefits against potential costs.

- Location: Properties in areas with high demand may not need the guaranteed income the scheme offers.

- Control: If you prefer direct control over tenant selection and property management, the scheme might feel restrictive.

Making the Right Choice: Questions to Ponder

Before diving into a guaranteed rent London Ilford, ask yourself:

- What Are My Financial Goals? Determine if the fixed income aligns with your investment objectives.

- How Much Control Do I Want? Decide if you’re comfortable with the agency handling all aspects of property management.

- Have I Reviewed the Fine Print? Ensure you understand all fees, terms, and conditions associated with the scheme.

Conclusion

The Guaranteed Rent Scheme offers a compelling proposition for landlords seeking steady income and reduced involvement in property management. However, it’s not a one-size-fits-all solution. Assess your individual circumstances, financial goals, and desired level of control before making a decision. Remember, what works for one landlord may not work for another.

Do your homework, weigh the pros and cons, and choose the best guaranteed rent London Ilford scheme that best suits your needs.