Essential Factors for Landlords to Evaluate Before Choosing Guaranteed Rent in Canary Wharf

Guaranteed rent schemes offer landlords in Canary Wharf a unique opportunity to secure steady income without the usual uncertainties of property management. However, before deciding on such a scheme, it’s crucial for landlords to thoroughly evaluate several key factors to ensure it aligns with their financial goals and property management strategy. In this blog, we will explore the essential considerations every landlord should weigh before choosing a guaranteed rent in Canary Wharf.

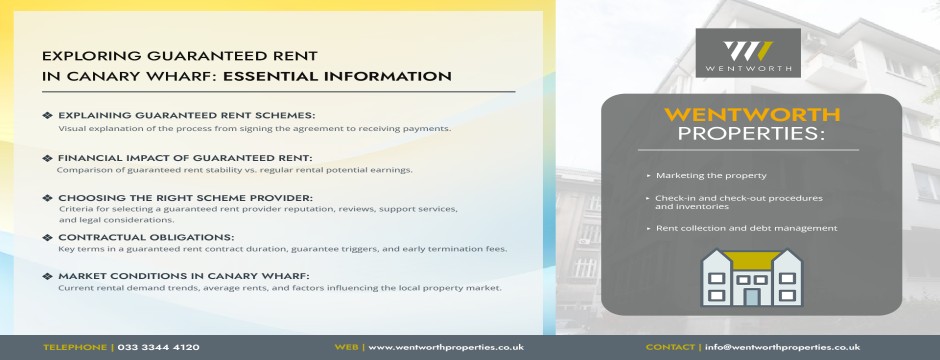

Understanding Guaranteed Rent Schemes

Firstly, let’s understand how guaranteed rent schemes work. These are agreements where a third party, like a property management company or lettings agent, promises landlords a steady rental income for a set time, even if their property doesn’t have tenants. This can be really reassuring for landlords, especially in places like Canary Wharf where rental demand can go up and down a lot. It helps landlords feel financially secure and less worried about their income.

Stats You Should Know About:

Private Rentals: 42% of homes in Canary Wharf are privately rented, compared to 25% across London.

Workday Population: Canary Wharf has a workday population of approximately 154,000 people .

Residential Population: Around 58,223 people reside in Canary Wharf.

Transport Hub: The Canary Wharf underground station sees about 82,000 exits on a typical weekday, making it the 10th busiest Underground station in London.

Average Rent: As of Q1 2022, the average rent achieved in Canary Wharf was £506 per week. There was a 13.1% increase in rents achieved on renewal compared to the previous year .

Property Sales: In 2022, there was a 48% annual increase in new home reservations. 93% of sales in the last 12 months were flats, and 61% of new developments have average asking prices of £1,000 per square foot or more.

Tenant Demographics:

27% of tenants are students.

49% of tenants already lived locally, moving less than a mile.

69% of tenants are under 30 years old .

[Source: https://residential.jll.co.uk/insights/news/spotlight-on-canary-wharf ]

Financial Implications and Income Stability

One of the main reasons landlords find guaranteed rent schemes appealing is the promise of steady income. Before choosing this setup, it’s crucial to think about its financial impact. While having a fixed income can bring stability, it’s important to compare it with what you could earn through regular renting. Also, consider any fees or commissions charged by the letting agent offering the scheme. Understanding how much money you’ll actually take home after these deductions is key to making a smart choice.

Choosing a reliable guaranteed rent letting agent Canary Wharf is essential for landlords looking to secure their income without worrying about vacancy or tenant issues.

Evaluating the Scheme Provider

When considering guaranteed rent schemes, landlords need to research and choose their providers wisely. Not all companies offering these schemes are equal. Here’s what landlords should do before committing:

- Research Thoroughly: Before signing anything, take the time to look into different companies that offer guaranteed rent schemes in Canary Wharf.

- Check Reputation: It’s crucial to find a company with a good reputation. Look for established guaranteed rent UK that has been around for a while and has a solid history of providing reliable services in Canary Wharf.

- Read Reviews: See what other landlords are saying. Reviews can give you insights into how well the company pays rent on time and handles property maintenance and tenant issues.

- Ask Around: Talk to other landlords who have used the service. They can provide recommendations based on their experiences.

- Assess Support: Look into what kind of support the company offers. This includes how they handle repairs and maintenance and how responsive they are to tenant needs.

Contractual Obligations and Legal Considerations

Before you sign any agreement, it’s crucial to carefully read through the terms and conditions of the guaranteed rent contract. Take special note of how long the contract lasts, when the guarantee kicks in (like the condition of your property or how often it’s occupied), and any fees you might face if you end the contract early. It’s a good idea to get legal advice to make sure the contract is fair to you and follows the laws that apply to landlords and tenants in Canary Wharf. This way, you can protect your interests and make sure you understand everything before committing.

Property Management and Maintenance Standards

Guaranteed rent Canary Wharf usually handles things like fixing things, keeping the property in good shape, and checking on it regularly. Landlords need to ask exactly what services are included and how well they’re done. Make sure these services meet your standards so your property stays in good condition. This helps keep its value up and makes it attractive to tenants.

Flexibility and Exit Strategies

Despite the stability that guaranteed rent schemes provide, landlords should think about how flexible they need the contract to be. They should check if they can change the rent rates or terms as time goes on. It’s also important to know how they can end the agreement if they need to. Having clear plans for how to leave the agreement helps landlords deal with changes in the rental market or their own situation without problems.

Market Conditions and Rental Demand in Canary Wharf

Lastly, landlords should assess current market conditions and rental demand trends in Canary Wharf. While guaranteed rent schemes mitigate vacancy risks, understanding the broader market dynamics can help in setting realistic expectations for rental income and making informed decisions about property investment and management strategies.

Conclusion

Guaranteed rent schemes can offer significant benefits to landlords in Canary Wharf, they require careful consideration and evaluation of various factors. By understanding the financial implications, assessing scheme providers, reviewing contractual obligations, ensuring property management standards, evaluating flexibility, and staying informed about market conditions, landlords can make confident decisions that align with their investment goals and enhance their experience of property management guaranteed rent in Canary Wharf.

Looking for expert advice on property management tips in Canary Wharf? Discover how Wentworth Properties can help you navigate guaranteed rent schemes with ease. Contact us today to optimise your rental income strategy!

Enhance Your Rental Strategy with Wentworth Properties

Steady Income Assurance: Secure steady income with Wentworth Properties in Canary Wharf!

Explore Rent Benefits: Discover guaranteed rent benefits with Wentworth Properties today!

Expert Rent Guidance: Get expert guidance on guaranteed rent from Wentworth Properties!

FAQ

A guaranteed rent scheme is an agreement where a property management company or lettings agent guarantees landlords a fixed rental income for a specified period, regardless of whether the property is occupied or not. This provides landlords with financial stability and peace of mind.

The main benefits include assured rental income, even during void periods, and relief from day-to-day management responsibilities such as tenant finding, property maintenance, and rent collection. It eliminates the risks associated with tenant vacancies and potential rent arrears.

It’s essential to research and compare different providers thoroughly. Look for companies with a strong reputation and a history of reliable service in Canary Wharf. Read reviews from other landlords, ask for recommendations, and assess the level of support and maintenance services offered.

Before committing, carefully review the terms and conditions of the contract. Pay attention to the duration of the agreement, conditions under which the guarantee applies (such as property condition and occupancy rates), and any fees or penalties for early termination. Legal advice can ensure the contract is fair and complies with local landlord-tenant laws.

The flexibility of rent adjustments varies among providers. Some contracts allow for periodic reviews and adjustments to rent rates, while others may have fixed terms. It’s crucial to clarify these terms before signing to ensure they align with your financial goals and market conditions.